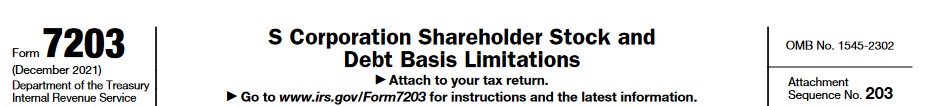

Form 7203: New IRS Form to Find Contributions Made to S Corporations

Every year the IRS issues new regulations and publishes new tax forms. There is one new form, Form 7203, that you may start seeing with your borrower’s most recent individual income tax returns. This will be extremely helpful for your cash flow analysis of S corporation shareholders.

What is Form 7203?

If you have a borrower who is a shareholder in an S corporation, you’ve generally always needed to obtain a copy of the Form 1120-S for the S corporation and look to the balance sheet to determine whether your borrower may have made contributions to the business. Now, the Form 7203 will likely be included with your borrower’s Form 1040 tax return, or you may find it attached to the Schedule K-1 from the S corporation. This form specifically reports whether an individual made contributions to the S corporation during the year on Part I, Line 2. The contributions reported on the Form 7203 could consist of either cash or property, so you will want to confirm with your borrower whether this actually represents a true cash outflow during the year. We also always recommend confirming whether the contribution is recurring or not.

How Does This New Form Compare to a Shareholders Basis Worksheet?

In a previous Bukers newsletter article, What Can the Shareholder’s Basis Worksheet Tell You?, we discussed how the Shareholder’s Basis Worksheet can be used to determine the contributions made by an S corporation shareholder to the business. The Form 7203 has a very similar format to the Shareholder’s Basis Worksheet, but is more reliable and official. The worksheet was simply produced by tax accountants or tax return preparation software programs. The Form 7203 represents the IRS’ official reporting form to be used to track a shareholder’s basis in an S corporation.

Please note, the Form 7203 is not required to be reported by every shareholder of an S corporation, so you may not always have this form available for your cash flow analysis. However, it appears that many tax practitioners are preparing the form regardless of whether it’s required. Keep an eye out for the Form 7203 when analyzing your borrower’s returns to capture any contributions by a shareholder to the S corporation.

If you have any specific questions when you encounter a Form 7203 or if you would like assistance in other areas of your cash flow analysis, feel free to reach out to our Bukers Hotline at 503-520-1303.