Excess Distributions: What Are They, and Are They Cash Flow?

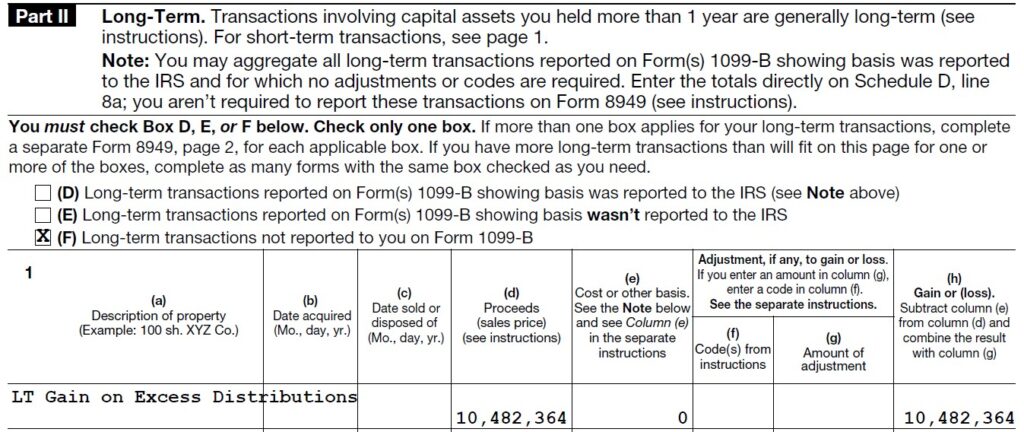

The Bukers Hotline received a call from a banker analyzing a Schedule D that included a long-term capital gain from excess distributions for about $10 million. Where do excess distributions come from? Is this cash flow for our prospective borrower?

The Schedule D is by far one of the most challenging forms to analyze in a cash flow analysis for many reasons. So many different types of transactions result in a capital gain or loss. We need to keep it all straight.

What Are Excess Distributions?

Excess distributions represent distributions paid from an S corporation to a shareholder in excess of the shareholder’s stock basis. The Schedule K-1 from an S corporation reports the total distributions received by the shareholder on Line 16 Code D. Generally, these distributions are not taxable for the shareholder and, therefore, not included anywhere on the shareholder’s Form 1040. This is why we capture the cash distributions directly from the K-1.

However, if a shareholder receives distributions that exceed their stock basis in the S corporation, the portion of the distribution exceeding stock basis is taxable. Typically, the excess distribution is taxed as a capital gain and reported on the Schedule D and Form 8949. Below is a screenshot of an example Form 8949 for this transaction.

At first glance, this looks like a big juicy cash inflow to include in your analysis. However, this only represents the portion of distributions received by this shareholder in excess of their stock basis in the S corporation. The total amount of distributions that the individual receives are shown on the Schedule K-1. Line 16D of the K-1 will include the combined total of the nontaxable distributions and the excess distributions. When analyzing the Schedule D for cash flow, you should not include excess distributions because these will already be separately accounted for when analyzing the Schedule K-1 for the S corporation.

Additionally, excess distributions are typically nonrecurring. Most individuals do not want to pay tax on their distributions received from S corporations if they don’t have to. Typically, distributions are paid out to the extent of the shareholder’s stock basis to ensure that the distribution is nontaxable. Make sure to carefully analyze the facts and circumstances for each borrower to assess the probability of recurrence.

Additional Questions

If you have any specific questions on complex transactions like this related to your cash flow analysis, please call the Bukers Hotline at 503-520-1303. As always, Bukers software users receive complimentary and unlimited access to both the Bukers Hotline and live software training.