Which W-2 Wages Are Used For Cash Flow?

An experienced banker called into the Bukers Hotline with a great question on wages and the Form W-2. Here was the situation:

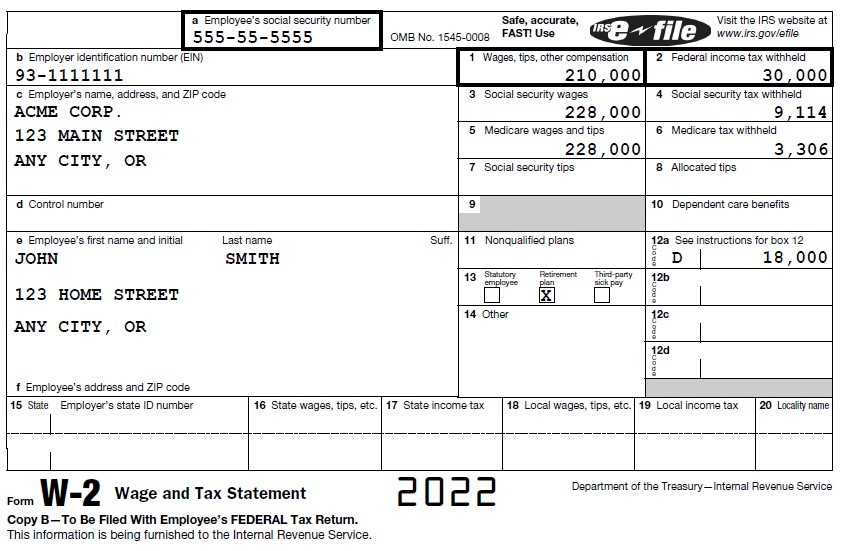

- The borrower’s Form 1040 reports $210,000 on line 1 “Wages, salaries, tips, etc.”

- The attached Form W-2 reports the same $210,000 on box 1 “Wages, tips, other compensation.”

- Box 5 of the Form W-2 reports $228,000 for “Medicare wages and tips.”

- Box 12 code D of Form W-2 reports $18,000.

The banker’s question: Which wage figure do I include in my cash flow analysis? Should I use wages from line 1 of the Form 1040 of $210,000 or the Medicare wages of $228,000 from box 5 of the Form W-2?

table.MsoNormalTable

{mso-style-name:"Table Normal";

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:"";

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:"Calibri",sans-serif;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;

mso-bidi-font-family:"Times New Roman";

mso-bidi-theme-font:minor-bidi;}

The Difference Between Box 1 and Box 5 on the Form W-2

Box 1 of the W-2 shows the total taxable wages while box 5 of the W-2 shows the total wages subject to Medicare tax. The primary difference is that elective deferrals, such as employee contributions to 401(k) and 403(b) retirement plans, are not included in Box 1 but are included in Box 5. The amount of the employee elective salary deferral is then reported on box 12 code D of the W-2.

Many companies offer 401(k) retirement savings and investing plans. Employees can elect to contribute a portion of their salary directly to the 401(k) retirement plan in lieu of receiving that amount as wages. This results in a big tax break as the employee contribution to the retirement plan is excluded from taxable wages on their tax return. So, an employee can choose to contribute a portion of their salary directly to a retirement plan without paying taxes on that income.

Referring to our example above, box 5 of the W-2 reports the combined total of (1) wages received during the year of $210,000 and (2) contributions made to a retirement plan of $18,000 during the year. Box 1 of the W-2 only reports the amount of the wages received by the employee of $210,000. This is reported directly on Line 1 of the Form 1040 as total wages. It represents the actual cash paid from the company to the employee.

What are the Cash Flow Implications?

For our cash flow analysis, we should use the wages from line 1 of the Form 1040. In this case, the amount of $210,000 represents the total cash paid from the company to the employee. Because the employee has chosen to contribute $18,000 directly to their retirement plan, the employer is actually making this contribution on behalf of the employee. The employee then receives the remaining amount, which is $210,000 for this example.

If we use the amount of $228,000 for our cash flow analysis, we will be overstating the borrower’s cash flow. The $18,000 has been contributed directly to a retirement plan where it cannot be accessed without penalties by the borrower until they reach retirement age.

As a Bukers Taxanalysis or Bukers BTA Pro software user, you receive unlimited access to the Bukers Hotline and live software training. Feel free to reach out with any questions on either this topic or any other areas of your cash flow analysis by calling into the Bukers Hotline at 503-520-1303. You may also submit an inquiry through our website and we will quickly get back to you.