Spreading Personal Financial Statements

The Bukers Taxanalysis software isn’t just for spreading personal tax returns. Did you know you can also spread up to 5 years of personal financial statements? Here’s how:

Starting a New Personal Financial Statement

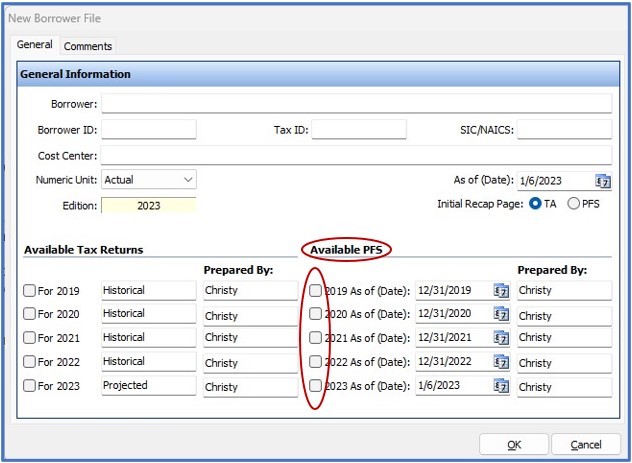

When you first begin a new file, fill in the borrower information as you normally do. At the bottom left of the “New Borrower” screen are check boxes for selecting the available tax returns for your borrower. On the bottom right of this screen is where you can select the available personal financial statements (PFS). Place a check mark next to all that apply. When done, click “OK.”

If you have already created a file without selecting PFS years, don’t worry. The next time you open the file, you can select them while on the “Open an Existing Borrower” screen.

Switching Between TA and PFS

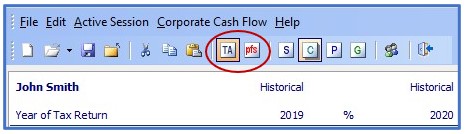

Now, when you are on the recap page, the menu at the top of the page has a button for TA (Taxanalysis) and PFS (Personal Financial Statement). Clicking on the PFS button will take you to the Personal Financial Statement recap page. Clicking on the TA button will return you to the Taxanalysis recap page. If you haven’t selected any PFS years, this button will be grayed out.

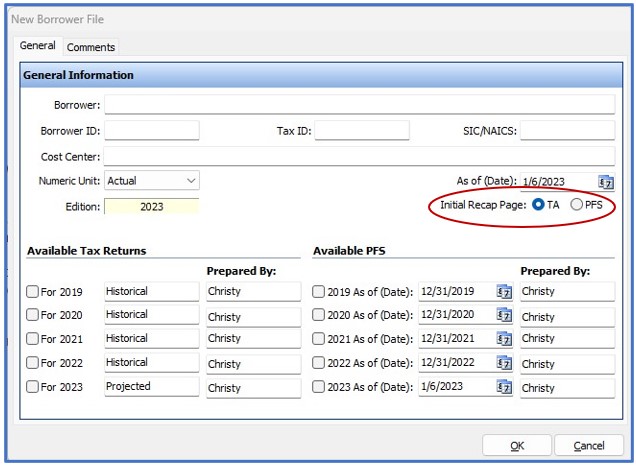

If you would like the PFS recap to be the default page for a specific borrower, on the “New Borrower” or “Open an Existing Borrower” screens, look for “Initial Recap Page.”

The PFS Recap Page

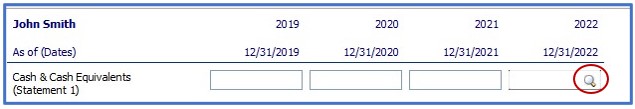

The Personal Financial Statement recap page works very similar to the Tax Return Analysis recap page. Most line items, when you click in a cell, will give you a magnifying glass button. Clicking on this button will let you drill down to provide more detail. You even have the ability to itemize an unlimited number of entries associated with that line item.

So, the next time a client provides you with their personal financial statements remember you can spread them in Bukers Taxanalysis! If you would like a walk-through of the PFS module in Bukers Taxanalysis, please give us a call at (503) 520-1303.