Debt Payment Calculator in Bukers Taxanalysis

Did you know the debt payment calculators in Bukers Taxanalysis provide multiple options for customization to help you determine your borrower’s ability to repay their loan? They do and we’ll show you how!

In Bukers Taxanalysis there are two debt payment calculators. One is for refinanced debt and can be found in the software on line 16 – Total Existing Annual Debt Service. The other is for proposed debt and can be found on line 18 – Projected Annual Payments on Proposed Debt. Both will calculate annual loan payments once you enter the following information:

- Loan Amount

- Annual Interest Rate

- Number of Payments Per Year

- Term of Loan (Months)

- Date of First Payment

Today we will cover the two most common approaches for adjusting the date of first payment when calculating Projected Annual Payments on Proposed Debt.

- Set the date of first payment as the initial date of your historical cash flow analysis. Using a past date will back fill historical columns with the loan payment amount and will show how your borrower’s historical cash flow would service the loan.

- Set the date of first payment as the projected date of first payment for the proposed loan. Using the projected date of first payment will show how your borrower’s projected cash flow will service the loan. Using today’s date or a date in the near future will only show the loan payment amount in the projected column. Loan payment data will not back fill historical columns.

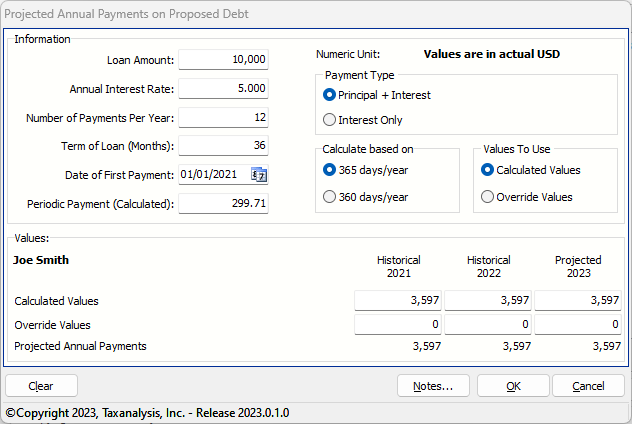

For Approach 1:

You have two years of tax returns for a new borrower – tax years 2021 and 2022. After spreading the tax returns, enter your projected cash flow data for 2023. When you get to the loan calculator for Projected Annual Payments on Proposed Debt, enter your loan data and set the date of first payment to January 1, 2021. Doing this will show, not only how your borrower’s historical cash flow would service the loan, but also how the projected cash flow would service the loan.

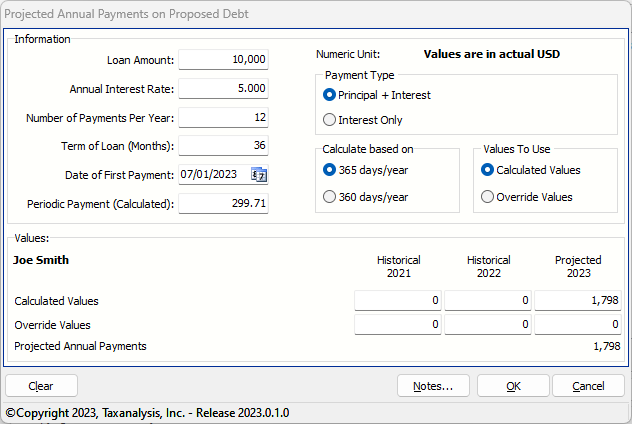

For Approach 2:

You have two years of tax returns for a new borrower – tax years 2021 and 2022. After spreading the tax returns, enter your projected cash flow data for 2023. When you get to the loan calculator for Projected Annual Payments on Proposed Debt, enter your loan data and set the date of first payment to the actual date of first payment for the proposed loan. For this example, we will use July 1, 2023. No loan data will appear in the 2021 or 2022 columns. Only 6 months of the loan payment will appear in the 2023 Projected column since the first payment is set for July 1, 2023.

You can also complete a “what if” analysis by changing the loan terms to see what the best fit for your borrower might be.

If you ever have any questions about using our software, please don’t hesitate to give us a call. There is never a charge for our customer support. You can call us M-F, 7am to 5pm PST at (503) 520-1303 with any questions you have while spreading your borrower’s tax returns and financial statements.