Section 179 Expense From Flow-Through

Is This Real Depreciation?

An experienced lender called into the Bukers Hotline this month with a question about Section 179 expense and the Schedule E. Here’s the situation:

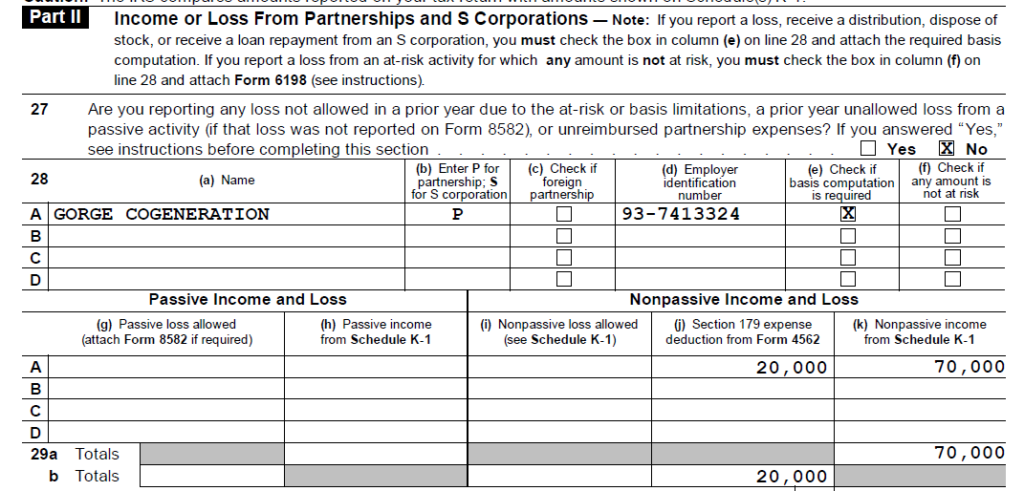

- Schedule E, page 2, column j shows “Section 179 expense deduction from Form 4562” of $20,000.

- The lender understands that Section 179 expense represents depreciation expense.

The lender’s question: Is this real depreciation that should be added back to the individual borrower’s cash flow?

Answer: No, the $20,000 shown on Schedule E, page 2, column j for Section 179 expense is simply passing through from the borrower’s partnership Schedule K-1. As such this is a “paper” pass-through item and you should ignore it. When we take a close look at the borrower’s K-1 from Gorge Cogeneration, we see Box 12 Section 179 Deduction reporting $20,000.

Part II of the Schedule E reports the individual’s share of pass-through income or loss from partnerships and S corporations. The values reported under columns g through k flow directly from the Schedule K-1 that the individual received this year. For our cash flow analysis, we should generally disregard the values shown under line 28 and instead analyze the actual Schedule K-1 to calculate cash flow from contributions, distributions, and guaranteed payments.

The purpose of this article is to show that even certain expenses can be “paper” pass-through items flowing from a Schedule K-1.

As a Bukers Taxanalysis or Bukers BTA Pro software user, you receive unlimited access to the Bukers Hotline and live software training. Feel free to reach out with any questions on either this topic or any other areas of your cash flow analysis by calling into the Bukers Hotline at 503-520-1303. You may also submit an inquiry through our website and we will quickly get back to you.