Avoiding Pitfalls on Schedule E - Pass-Through Activity

Last month, we discussed how to avoid pitfalls on Schedule E related to passive activity losses. We are going to look at the same analyst’s question, but this time we will emphasize the potential pitfalls related to income or loss from pass-through entities. Let’s start by reviewing the details of the analyst’s question.

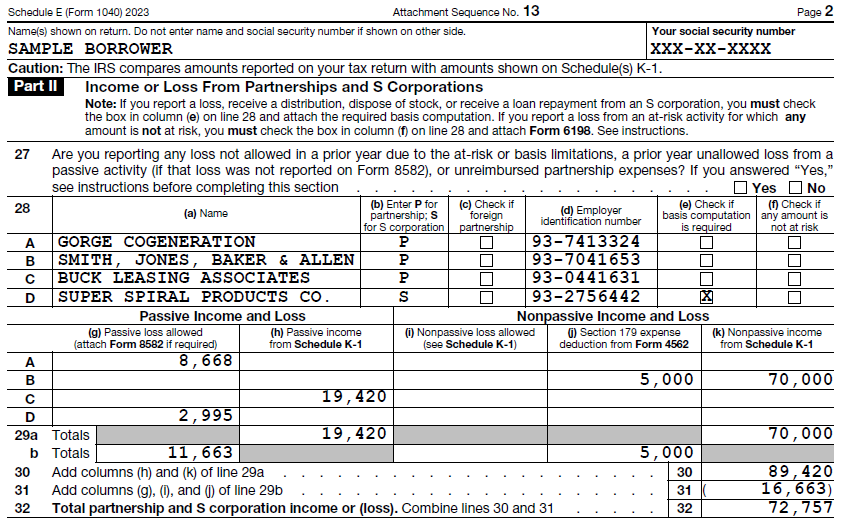

We received a call on the Bukers Hotline where a new analyst was trying to spread cash flow from Schedule E, which breaks out income and losses from rental and royalty activities, as well as partnerships, S corporations, and other pass-through entities. The analyst’s first inclination was to use the amount listed on Form 1040, Schedule 1, Line 5 as the cash flow from Schedule E. We told the analyst that there are multiple reasons why that number could be distorted and is not an accurate representation of Schedule E cash flow.

Why Pass-Through Income/(Loss) is Not Cash Flow

Page 2 of Schedule E is where you will find the income or loss from partnerships, S corporations, and other pass-through entities like estates and trusts. For an unwary analyst, it would be easy to examine Page 2 of Schedule E and notice several items of income that they might want to include as sources of cash flow. But what are the real sources of cash flow as listed on Page 2 of Schedule E? The answer is – None! The pass-through income or loss reported on Page 2 of Schedule E is simply “paper” income that represents the borrower’s individual share of income or loss earned by the pass-through entity.

For partnerships and S corporations, these items of income or loss listed on Schedule E flow in directly from the borrower’s Schedule K-1 and they do not represent real cash received by the borrower. To figure out our true cash flow to the borrower from pass-through entities, we need to analyze their Schedule K-1 for any recurring distributions or guaranteed payments received. We also need to consider any recurring contributions made to the pass-through entity by the borrower, as these would decrease our cash flow to the borrower.

Let’s look back at the call we received on the Bukers Hotline regarding Schedule E income. The issue with using the amount on Schedule 1, Line 5, is that it includes the aggregation of all pass-through income as listed on Page 2 of Schedule E, which we now know is simply “paper” pass-through income and does not represent real cash received by the borrower. If we want to figure out cash flow to the borrower from pass-through entities, we know that we need to examine the Schedule K-1s received.

Want More Detail on This?

The Bukers Academy Online training explores this topic in greater detail in its analysis of Schedule E cash flow. There are additional examples that go into greater depth on this topic and even more from Schedule E. If you would like more information on enrolling in the Bukers Academy Online, please email us at bukers.academy@taxanalysis.com or give us a call at (503) 520-1303.