Avoiding Pitfalls on Schedule E - Passive Losses

We recently received a call on the Bukers Hotline where a new analyst was trying to spread cash flow from Schedule E, which breaks out income and losses from rental and royalty activities, as well as partnerships, S corporations, and other flow-through entities. The analyst’s first inclination was to use the amount listed on Form 1040, Schedule 1, Line 5 as the cash flow from Schedule E. We told the analyst that there are multiple reasons why that number could be distorted and is not an accurate representation of Schedule E cash flow. Today we will highlight potential pitfalls associated with rental and royalty activities on Schedule E.

Passive Loss Limitations

Focusing first on the rental and royalty activities, it is important to first understand that these activities can very often be considered “passive” in the eyes of the IRS. For example, if someone is collecting rental income from listing a vacation property on Airbnb and that is not their primary occupation, the IRS would likely consider that a passive source of income or loss to the individual. When someone operates a passive activity, the losses that they can deduct from that activity can be limited subject to the applicable passive activity loss limitations.

The calculation of passive loss limitations is shown on Form 8582, which flows to Schedule E, Line 22 and affects the recognized income/loss amount that is reported on Form 1040, Schedule 1, Line 5. For this reason, we always advise our users to take a “reconstructive approach” when it comes to spreading cash flow on Schedule E because this will help us ignore these “paper” limitations. Let’s look at an example of this situation.

Example

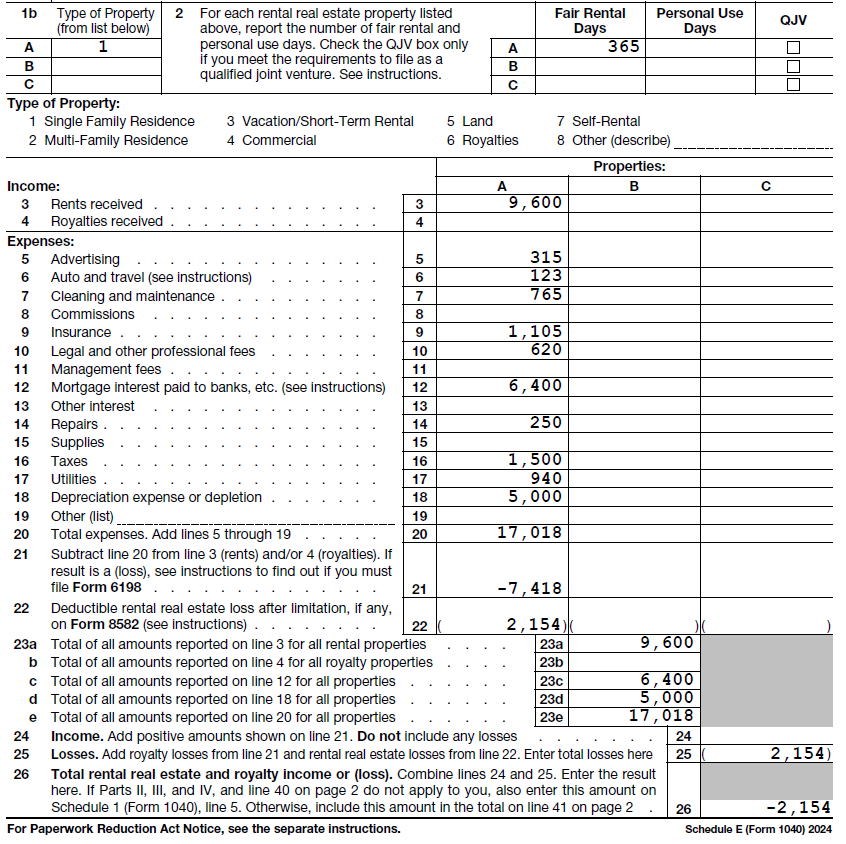

Our borrower’s Schedule E shows a rental activity that is in an economic loss position of -$7,418 for the year. We can see on Line 22 that the deductible amount of the rental loss is limited to -$2,154, and this amount flows to Line 26, which will then be added to the calculation of total income/loss from Schedule E as reported on Schedule 1, Line 5.

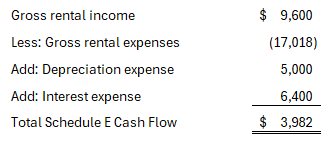

If we were to simply use the net amount of income/loss reported on Schedule 1, Line 5 as our Schedule E cash flow, we would be using a completely distorted figure that does not resemble cash flow; but instead, is influenced by artificial loss limitations imposed by the IRS. So how do we deal with spreading this Schedule E? As the Bukers Taxanalysis software instructs, we need to begin by subtracting gross expenses from gross income. After that, we can add back depreciation and interest expense to arrive at gross cash flow from Schedule E. Please see our calculation below:

As you can see, our true cash flow from Schedule E is significantly higher than the amount of passive losses that were allowed to flow through to Schedule 1, Line 5 of Form 1040. This is a great example of why it is crucial to avoid taking any shortcuts when spreading an individual borrower, since there are too many pitfalls that can distort true cash flow from the borrower.

Want More Detail on This?

The Bukers Academy Online training explores this topic in greater detail of its analysis on Schedule E cash flow. There are additional examples that go into more depth on this topic and more from Schedule E. If you would like more information on enrolling in the Bukers Academy Online, please email us at bukers.academy@taxanalysis.com or give us a call at (503) 520-1303.