Cash and Noncash Contributions on a K-1

Are They Capital Contributions or Charitable Contributions?

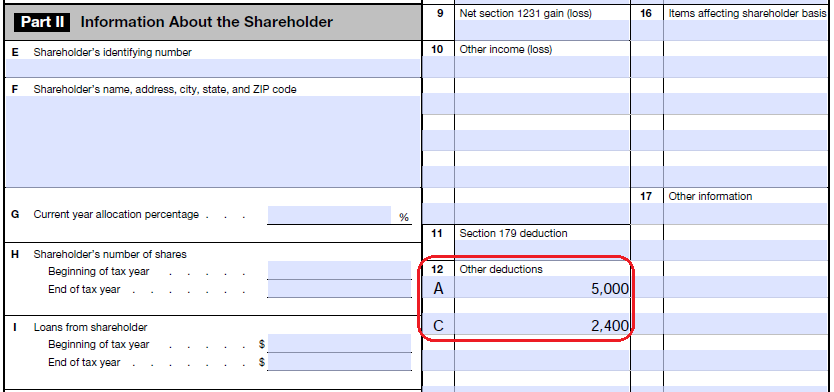

Have you ever looked at the Schedule K-1 from an S corporation and found values reported on Line 12 Other Deductions with corresponding letter codes, but no description of the actual deduction? An analyst recently called into the Bukers Hotline with a K-1 showing:

This analyst is sharp and looked up the K-1 codes for the Schedule K-1 (Form 1120-S). Per the List of Codes found in the IRS publication Shareholder’s Instructions for Schedule K-1, Code A on Line 12 reports “Cash contributions” and Code C on Line 12 reports “Noncash contributions.” She asked if these line items refer to capital contributions made to the S corporation from the shareholder.

Good question! What's the answer?

These two line items on the K-1 do not represent capital contributions. Instead, these values refer to charitable contributions (donations) made by the S corporation to charitable organizations. Line 12, Code A reports contributions of cash to charities while Line 12, Code C reports the value of property, such as equipment and office furniture, donated to charities.

The values reported on Line 12, Code A and Line 12, Code C of the K-1 represent the shareholder’s respective share of the charitable donations made by the S corporation. These are not actual capital contributions of any sort; they should be ignored and not included as a cash flow item to the borrower.

Note: The same applies to K-1s from partnerships; the only difference is that Other Deductions are reported on Line 13 of the Schedule K-1 (Form 1065). Specifically, Line 13, Code A reports cash contributions to charities and Line 13, Code C reports noncash contributions to charities. You can find more detail on the partnership K-1 codes in the IRS publication Partner’s Instructions for Schedule K-1. We apply the same logic to a partnership K-1. These are not actual capital contributions and should not be included as a cash flow item to the borrower.

Do you have questions like this when analyzing tax returns or financial statements? Reach out to our team of experts through the Bukers Hotline at 503-520-1303. You may also submit a question through our website and we will quickly get back to you.