Does a Change in Partnership Ownership Affect a Borrower's Cash Flow?

Have you ever looked at a Schedule K-1 from a partnership and seen significant decreases in the profit, loss, and/or capital percentages? An analyst recently called into the Bukers Hotline to ask whether she needs to make an adjustment to her cash flow analysis for the decrease in her borrower’s ownership percentages. The answer depends on a few factors.

Scenario #1: Cash Contribution

One possible explanation requiring no adjustment is that a new outside partner simply contributed cash to the business to buy into the partnership during the year. For example, assume your borrower, Albert, is a 50% partner in AB Partnership with one other person (let’s say Bob). During the year, Cathy buys into the partnership and now all three individuals are equal one-third partners in the partnership. In this scenario, Albert did not sell or divest any portion of his ownership in the partnership. Cathy contributed additional funds to the partnership that the business can leverage to fund new projects to generate additional revenue. No adjustment is required as we can reasonably project that the business will generate similar or increased revenue figures resulting in similar distributions to Albert.

Scenario #2: Sale of Partnership Interest

An alternative possibility is that your borrower sold either a portion or the entirety of their ownership share in the partnership. Let’s start with the same example from above where our borrower, Albert, is a 50% partner in AB Partnership. This time, Cathy chooses to purchase a portion of both Albert and Bob’s ownership interest in the partnership directly.

In this scenario, Cathy pays cash directly to Albert and to Bob in exchange for an ownership share in the partnership. This transaction occurs outside of the partnership. The end-result is the same as Albert, Bob, and Cathy now are all one-third partners in the partnership. The difference is that the business did not receive additional funding since Cathy paid cash directly to Albert and Bob for their shares rather than contributing cash to the business in exchange for additional ownership units. For our cash flow analysis of Albert, there are two things to now consider:

- Albert’s Schedule D will report a capital gain/loss from the sale of his partnership interest to Cathy. This sale will likely be non-recurring.

- Albert will likely receive a lesser distribution from the partnership moving forward since he sold off a significant portion of his ownership in the partnership. This should be noted within the cash flow analysis and an adjustment may be warranted.

How Do You Know if a Sale Occurred?

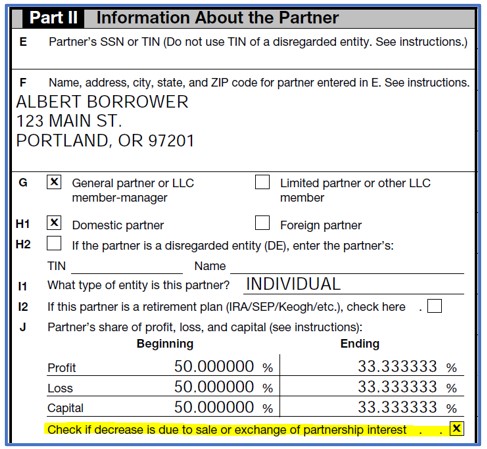

Now, how can we know whether our borrower actually sold off a portion of their partnership interest? The Schedule K-1 will tell us. The partnership K-1 provides a checkbox under Part II, Item J to indicate whether a decrease in ownership percentages is due to a sale or exchange. With our examples above, the box will be checked only for the second scenario where Albert sold a portion of his partnership ownership directly to Cathy.

The partnership K-1 is filled with many clues like this. If you have any similar questions, we encourage to you reach out to our team of experts through the Bukers Hotline at 503-520-1303. You may also submit a question through our website and we will quickly get back to you.