Different S Corporation Distributions Reported on Form 1120-S

How to Properly Identify Actual Distributions

Have you ever spread a business tax return for an S corporation and noticed that the Form 1120-S reported multiple different distribution amounts? This may result in an out-of-balance retained earnings reconciliation within your analysis.

It’s imperative that you use the correct value of actual distributions in your analysis.

S Corporation Example with Different Distributions

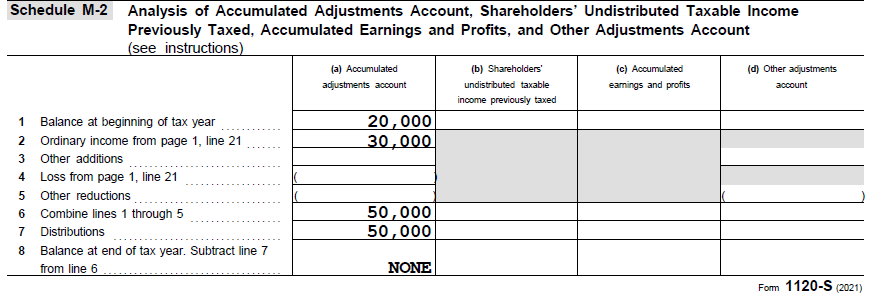

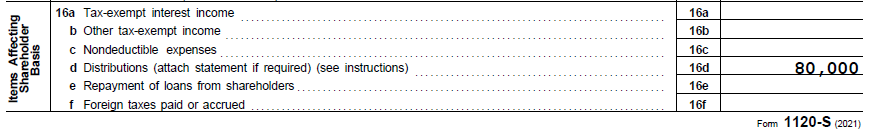

A senior credit analyst recently called the Bukers Hotline with this situation for an S corporation. The Schedule M-2 reported $50,000 in distributions on line 7 while the Schedule K reported $80,000 in distributions on line 16d. Typically, these two amounts match. In this case, the analyst had no idea which amount reflected the actual distributions paid out by the S corporation.

Schedule M-2 Example

Schedule K Example

Column A of the Schedule M-2 calculates the Accumulated Adjustments Account (AAA) for the S corporation, which is a measure of the company’s accumulated income, less expenses, that have not been distributed. In other words, this is similar to the concept of retained earnings but is calculated specifically for tax purposes. We will forego discussing further nuances of the tax minutia for the scope of our discussion.

By general rule, the AAA cannot be decreased below zero for distributions made by the S corporation. If a corporation makes a distribution of a greater value than the remaining AAA balance on line 6 of the Schedule M-2, the distributions on line 7 of the Schedule M-2 will be limited to the value on line 6 and will differ from the amount reported on line 16d of the Schedule K. In our analyst’s example, the S corporation actually distributed $80,000 to its shareholders during the year. The tax code simply limits the amount that can be reported on line 7 of the Schedule M-2 due to the nuances involved in calculating AAA.

How This Impacts Your Tax Return Analysis

We recommend that when spreading an S corporation return with this scenario, record the true distributions as reported on line 16d of Schedule K. If your analysis showed an out-of-balance retained earnings reconciliation, this adjustment should bring retained earnings back in balance and provide the most accurate cash flow analysis.

If you’re interested in more detailed explanations like this, take a look at Bukers Academy Online. Our new online training platform breaks down complex topics like this into interactive learning modules designed to teach the advanced concepts necessary to analyze complex tax returns.