Should I Include the Federal Tax Refund in My Cash Flow Analysis?

Should the Federal tax refund be included in the cash flow analysis of your borrower’s tax return? This is a question we commonly hear from lenders and analysts.

Most individuals receive tax refunds when they file their Form 1040. But, is this something we should actually include in our cash flow calculation?

Federal Tax Refund on Form 1040

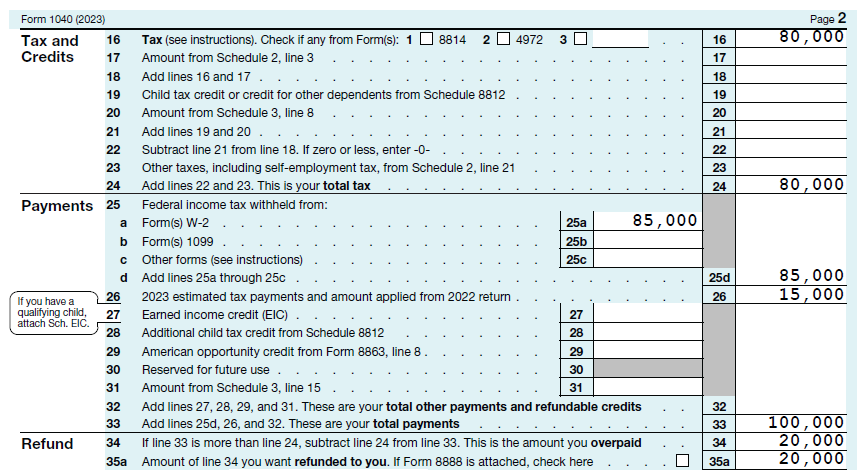

The Form 1040 reports the taxpayer’s total tax obligation on line 24. The total tax payments made during the year are totaled on line 33. When the tax payments exceed the taxpayer’s total tax due, the excess is either applied to the next year or refunded directly to the taxpayer, as shown on line 35a.

Cash Flow Impact

While the Federal tax refund is a cash inflow for the taxpayer, this should be disregarded when analyzing your borrower’s tax return in the Bukers Taxanalysis software.

Before arriving at our calculation of cash available for debt service (CAFDS), we capture the total Federal tax obligation for our borrower. We find this amount on line 24 of Form 1040. This represents the total tax owed by the taxpayer for the year based on their taxable income.

The tax payment and refund information is essentially meaningless as it only tells us whether the taxpayer overpaid or underpaid their tax liability during the year. Look at the example above. Let’s imagine that the borrower expected a larger tax obligation and made more estimated payments so their total payments on line 33 totaled $280,000. This would result in an overpayment and potential refund of $200,000. This hypothetical doesn’t change the fact that their total Federal tax obligation is still $80,000 as shown on line 24.

The Bottom Line

Our ultimate objective is to determine our borrower’s cash available for debt service. To account for their Federal taxes, we use their actual tax obligation as shown on line 24. We ignore the payment and refund amounts.

Note, in calculating recurring cash flow for your borrower, it may be appropriate to adjust the Federal taxes reported on line 24 to account for your borrower’s nonrecurring income or expense. This is a concept we discuss thoroughly in Bukers Academy Online, which teaches the theory and complexities of tax return analysis through an interactive, web-based learning platform.