Using Form 8995 to Identify Your Borrower's K-1s? Think Again!

When analyzing the cash flow of an individual who is either a business owner or has investments in multiple businesses, your immediate priority is to make sure that you have received a copy of every Schedule K-1 that the individual has received. Whether the K-1 is from a partnership or an S corporation, we need the K-1 to track the actual cash flow from the pass-through entity to the individual. How can you ensure that you’ve received every K-1 though? Did you know there are certain forms and schedules included with the Form 1040 that may be deceiving?

We recently received a call on the Bukers Hotline where a banker was looking at his borrower’s individual tax return and asked this very question, “how can I be certain that I have received a copy of every K-1 from my borrower?” This banker was looking at the Form 8995 and was properly confused.

What is the Form 8995?

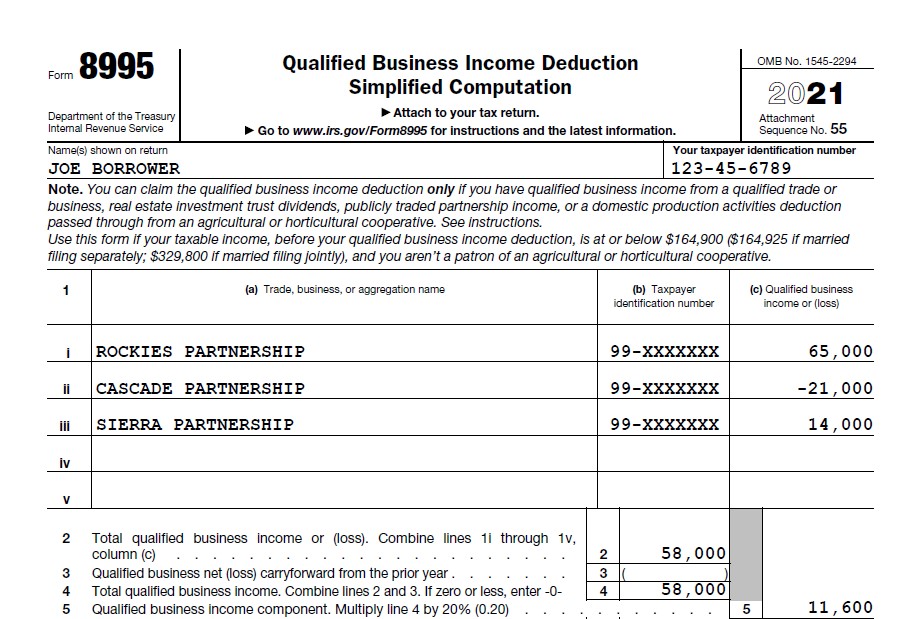

The Form 8995 is a relatively new form that is used to calculate the qualified business income (QBI) deduction found on page 1 of the Form 1040. The QBI deduction was a new addition to the tax code from the Tax Cuts and Jobs Act of 2017. The QBI deduction can equal up to 20% of an individual’s income from pass-through entities and the calculation of this deduction is reported on the Form 8995. Where this gets confusing is that the Form 8995 may track the income of every trade or business separately. If your individual borrower is involved in a tiered partnership structure, then you will likely see multiple entity names reported on the Form 8995 that your borrower does not actually receive a K-1 from. This can be very misleading to a banker who is trying to ensure that all K-1s are properly accounted for.

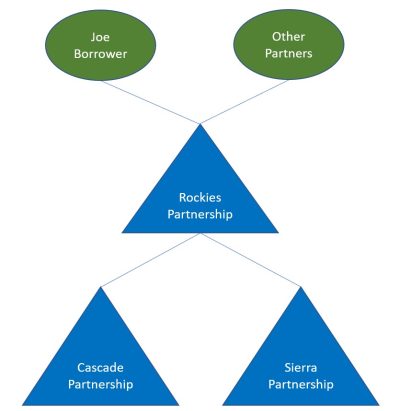

Consider the following example where Joe Borrower receives only one K-1 during the year from Rockies Partnership.

This is an example of a tiered partnership. Joe is a partner in Rockies Partnership and receives a K-1 from this entity only. Rockies Partnership is a direct partner in both Cascade Partnership and Sierra Partnership; Rockies Partnership receives K-1s from both lower-tier partnerships. The issue that this structure causes with the Form 8995 is that Joe’s Form 8995 included with his Form 1040 may include separate line items for all the lower-tier partnerships as exhibited below.

Our Bukers Hotline caller encountered this exact situation. He had a Form 8995 reporting multiple entities, but only had one K-1 from his borrower. The caller wanted to confirm that he wasn’t missing any K-1s.

Bottom Line

Because the Form 8995 can report all lower-tier partnerships as separate business activities, the form should not be used to identify the number of K-1s a banker should receive to complete a cash flow analysis. Instead, refer to page 2 of the Schedule E which reports the partnerships and S corporations that the individual has direct ownership in. You should make sure to receive a K-1 from each entity listed on Schedule E, Page 2, Part II. For this process, the Form 8995 can be greatly misleading.

As a user of the Bukers Taxanalysis or BTA Pro software, you receive unlimited access to the Bukers Hotline and live software training. If you have questions on this topic or if you would like assistance in other areas of your cash flow analysis, please reach out to our Bukers Hotline at 503-520-1303.