Form 8990 and Business Interest Expense:

Cash Flow Impact

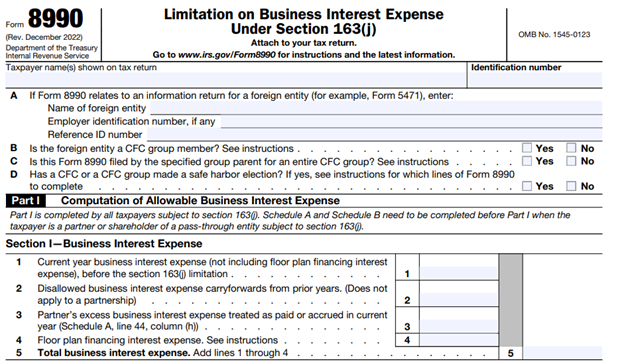

Have you ever come across the Form 8990 in an individual or business tax return and wondered if this impacts your cash flow analysis? This form can provide key information regarding the total interest expense paid by an individual or business; here’s what you should know.

Section 163(j): Limitation on Business Interest Expense

One of the more notable tax changes from the Tax Cuts and Jobs Act was the amendment of Section 163(j) to limit the deductibility of interest expense for individuals, pass-through entities, and corporations. The interest expense deduction limit is based on a number of factors, but lenders should just be aware that a discrepancy may exist between interest expense deducted and actual interest expense paid by the entity or individual.

There is an important exclusion that allows “small business” taxpayers and entities to avoid the limitation of the interest expense deduction. Many borrowers will not have to worry about their interest expense deduction being limited by the IRS, as long as their average gross receipts are less than $27 million over the prior three-year span. There are some exceptions to that rule which may cause an entity to file a Form 8990 for informational purposes without having its interest expense deduction limited.

Form 8990: Main Takeaway

The main takeaway from all of this information is to be aware that there may need to be an adjustment in arriving at actual interest expense paid for taxpayers who are limited by Section 163(j). The good news for lenders is that Form 8990 shows the breakdown of actual interest expense paid versus what was allowed as a deduction on the tax return. Generally, Part I, Section I, Line 1 reports the total current year interest expense prior to the application of the limitation. However, there are numerous caveats and exceptions that may be applicable, depending on your borrower’s facts and circumstances.

This is a complex tax issue that even confuses seasoned tax professionals. The bottom line for your cash flow analysis is to ensure that you’re capturing the total interest expense paid by your borrower.

To better understand how Section 163(j) and the Form 8990 impacts your tax return spreading process, please call into our team of experts through the Bukers Hotline at 503-520-1303. We look forward to hearing from you.