"Hidden Expenses" on Schedule C

We recently received a great question on the Bukers Hotline about spreading an individual’s sole proprietorship (Schedule C). Most lenders are aware that they need to add back depreciation, amortization, and interest expense as listed on Schedule C, Part II, to arrive at Total Schedule C Cash Flow. However, did you also know that non-cash expenses could be hidden in Schedule C, Part III?

Schedule C Part III Explanation

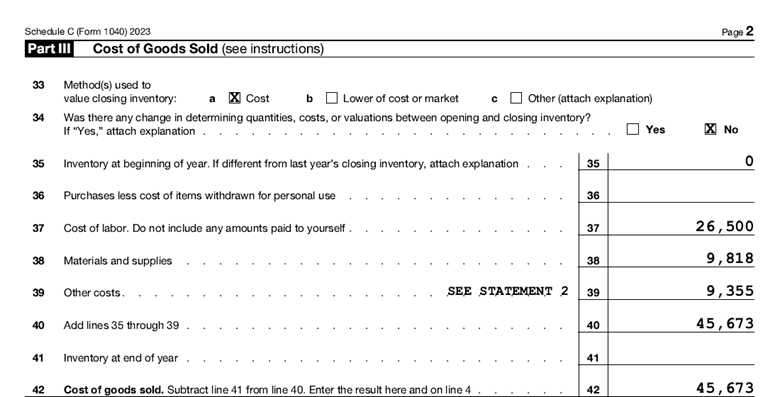

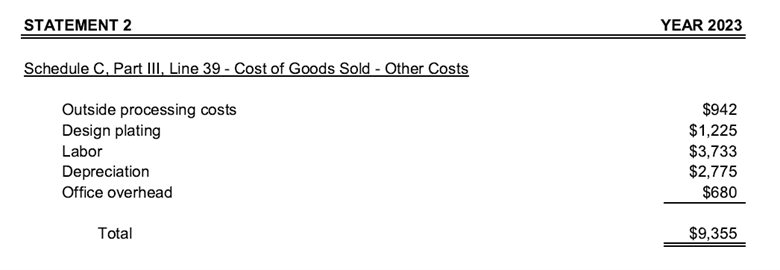

Part III of Schedule C reports the calculation of Cost of Goods Sold for the sole proprietorship during the given tax year. A business may allocate a portion of its non-cash expenses, like depreciation, amortization, and interest expense, to Cost of Goods Sold based on its manufacturing practices. If that is the case for your borrower, those allocated expenses will be aggregated on Schedule C, Part III, Line 39 – Other Costs. The breakout of those Other Costs is listed in an attached statement. From a lending perspective, it is critical that we are aware of the breakout of expenses that are lumped together on Line 39 – Other Costs and always check the statement detail to see if any addbacks are required.

Example

Let’s say that Part III of our borrower’s Schedule C shows Other Costs on Line 39 of $9,355 with a notice “SEE STATEMENT 2”. Our first thought should be to find Statement 2 and analyze it for any expenses that may need to be added back to cash flow. Upon further examination, we see that there are $2,775 worth of depreciation expenses classified under Cost of Goods Sold. We need to make sure that we add back this amount to cash flow for Schedule C to avoid understating our cash flow available to service debt.

Want More Detail on This?

The Bukers Academy Online training explores this topic as a component of the Sole Proprietorship module. There are valuable examples that help reinforce this concept in greater detail, including addbacks of other expenses besides depreciation expense.

Curious to see if Bukers Academy Online is a good fit for you and your institution? Please email us at bukers.academy@taxanalysis.com or give us a call at (503) 520-1303.