Why Does My Borrower Have Multiple Schedule D's?

Have you ever noticed two different versions of the Schedule D included with your borrower’s Form 1040? How can you tell which version of the Schedule D should be used for your cash flow analysis and which one should be ignored? An analyst recently called into the Bukers Hotline with this exact question. It’s imperative that you know how to identify the proper Schedule D for your cash flow analysis.

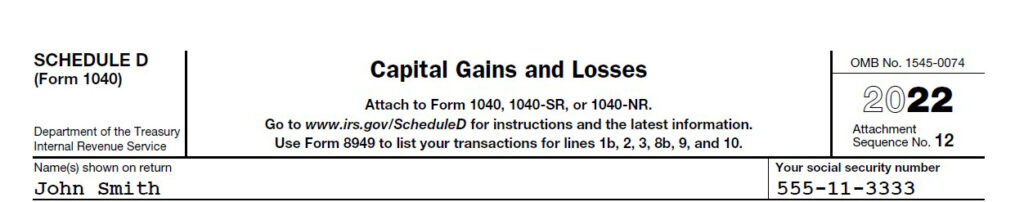

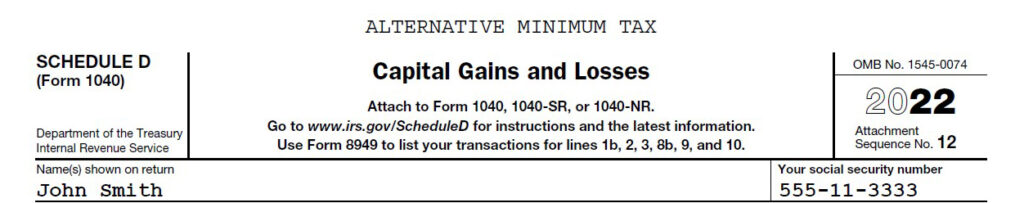

The primary reason that you may find two different versions of the Schedule D reporting different values of capital gains or losses is that that your borrower may be subject to Alternative Minimum Tax (AMT). One Schedule D will report the capital gain or loss for the calculation of regular income tax and the other Schedule D will report the capital gain or loss for the calculation of AMT. To tell the difference between both schedules, look at the header on the page. The Schedule D used for calculating regular income tax will be blank or appear as normal. The AMT Schedule D will be marked with “Alternative Minimum Tax” on the header.

What is Alternative Minimum Tax?

AMT was created to attempt to ensure that all taxpayers pay a certain “minimum” amount of tax. It is specifically designed to affect taxpayers who shelter income against other investments that generate substantial paper losses and tax credits that offset cash income. Different rules and regulations apply to the calculation of AMT compared to regular tax, so you will see a separate Schedule D for each calculation. A personal tax return may include regular tax and AMT versions of several other forms and schedules, including:

Bottom Line

When completing your cash flow analysis, utilize only the regular tax version of the form or schedule you are analyzing. Simply ignore the form or schedule that shows “Alternative Minimum Tax” as a header since this form is solely used for the calculation of AMT. The worst mistake you can make is to include the values from both forms in your cash flow analysis. You would be double-counting the cash flow in this case, thereby overstating cash available to service debt.

If you have any similar questions, we encourage to you reach out to our team of experts through the Bukers Hotline at 503-520-1303. You may also submit a question through our website and we will quickly get back to you.