Ordinary vs. Qualified Dividends

We recently received a call on the Bukers Hotline where a new software user was trying to spread cash flow from Schedule B, which breaks out cash inflows from interest and dividends. The user was asking us how to treat ordinary and qualified dividends, suggesting that they might want to add qualified dividends on top of the ordinary dividend amounts reported on Schedule B to their calculation of cash flow. We informed the user that their proposed method is not the proper treatment, but let’s dig a little further into why that is the case.

Analysis and Example of Qualified Dividends

It is understandable where our user is coming from with their question. They want to make sure they’re giving the borrower as much credit as possible for any sources of cash inflow, including dividends. However, making separate entries to cash flow for both ordinary and qualified dividends will result in double counting. Both ordinary and qualified dividends are listed on Page 1 of Form 1040, so how do we avoid double counting?

The key is to remember that all qualified dividends are included in the amount reported for ordinary dividends, however not all ordinary dividends are qualified dividends. The qualified dividends are taxed at preferential rates, lower than the rates used to tax ordinary dividends, therefore the IRS delineates the two types of dividends for the purposes of calculating tax due. Bear in mind, none of this affects actual cash flow to the borrower; it is simply presentational and for tax purposes. Let’s take a look at an example to help reinforce this concept.

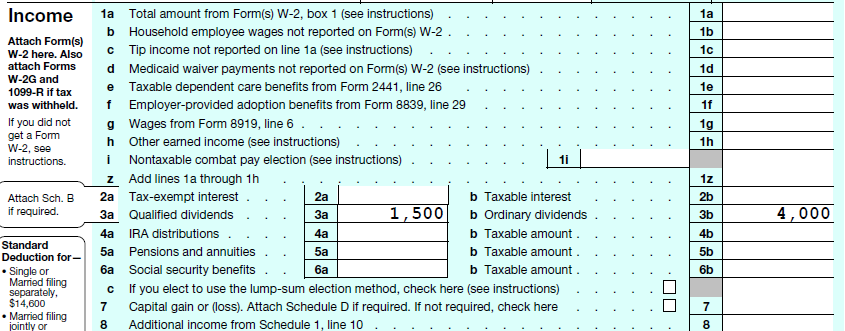

Let’s say our borrower’s Form 1040 reports qualified dividends of $1,500 on Line 3a and ordinary dividends of $4,000 on Line 3b. This means that the borrower has received $4,000 in dividends for the year, and out of that amount, $1,500 is considered “qualified” and therefore is taxed at preferential rates. The remaining $2,500 of ordinary dividends are taxed at ordinary rates. For our cash flow analysis, we will add $4,000 of dividends as a cash inflow for our borrower.

Want More Detail on This?

This topic is a great example of the way various tax complexities can find their way into cash flow analysis. The Bukers Academy Online training explores this topic in greater detail in its analysis of Schedule B cash flow. If you would like more information on enrolling in the Bukers Academy Online, please email us at bukers.academy@taxanalysis.com or give us a call at (503) 520-1303.