The Most Overlooked Adjustments for Real Estate Sales on Schedule D

The Schedule D reports capital gains and losses from the sales of investment assets. When a borrower sells real estate, the transaction will be reported on the Schedule D. There are two very critical adjustments we need to make for our cash flow analysis that are consistently overlooked. Please note, these adjustments should also be considered with asset sales reported on Form 4797. Let’s break them down.

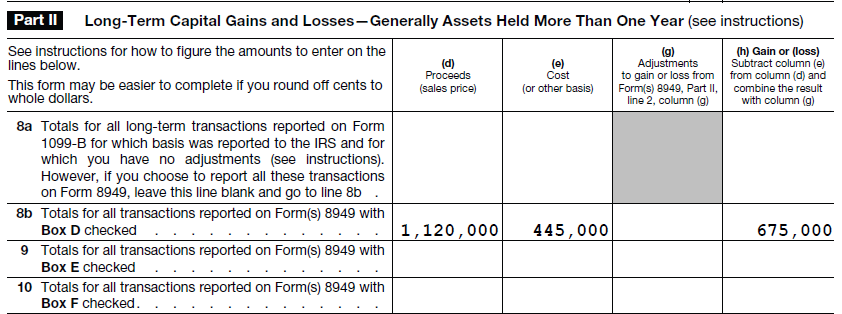

Schedule D Scenario

A Schedule D shows a sale of real estate (raw land) in Part II with a long-term capital gain of $675,000. It was originally bought years ago for $445,000 and refinanced twice in its lifetime. It recently sold for $1,120,000.

Cash Flow Analysis

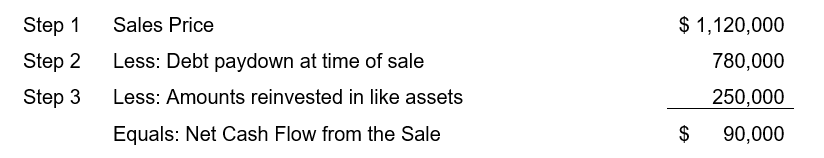

The lender initially looking at this tax return may think the cash from the sale is the gain of $675,000. That is wrong. To calculate the cash flow from asset sales on either Schedule D or Form 4797 requires a three step approach.

Step 1 – Start with Sales Price

The first step is to add the total “Sales Price” which in this case is the $1,120,000.

Step 2 – The First Critical Adjustment

The second step, which is the first critical adjustment, is to subtract any debt paid off at closing when this property was sold. A quick check of the closing statement reveals that debt paid off at closing was $780,000. This amount needs to be subtracted from the Sales Price in Step 1 which reduces the cash from the sale.

Step 3 – The Second Critical Adjustment

The third step, which is the second critical adjustment, is to subtract any portion of the net cash from the sale that was reinvested in like real estate. A quick call to the borrower reveals that $250,000 was used to purchase another piece of property. So, you need to subtract $250,000 from the remaining cash in Step 2.

Net Cash Flow from the Sale

This leaves $90,000 available to the borrower, after all the smoke clears, for “other” debt servicing and is all that you should attribute to them as cash flow.

Final Assessment

Again, with any asset sale on Schedule D or Form 4797 (but particularly so with real estate since it so frequently has large debt paid down at closing) you should make a three-point series of adjustments:

Note, the adjustments in Steps 2 and 3 are not items that will be included with your borrower’s Form 1040 tax return. With real estate transactions, you need to request closing statements or specifically ask your borrower for the debt paid down at closing and any amounts reinvested. If someone tells you to just pick up the net gain, that is WRONG and they are not thinking through this fully.

Our brand new Bukers Online Academy training course discusses these two adjustments in detail, along with so much more. Whether your lenders and analysts are new to spreading tax returns or have years of experience, they will improve their skills through our training.