What are Retained Earnings Adjustments on Schedule M-2 for a Form 1120S?

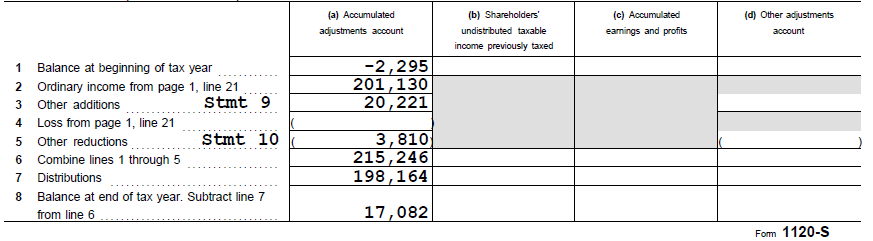

We frequently receive questions on the Bukers Hotline about spreading the Schedule M-2 of Form 1120S, specifically regarding retained earnings adjustments. While it can be somewhat uncommon to have retained earnings adjustments on the Schedule M-2, they are important items to be aware of when spreading an S Corporation tax return.

Schedule M-2 Application

When spreading the Schedule M-2 of Form 1120S in Bukers BTA Pro, you will see instructions in red font on Line 3 Other Additions and on Line 5 Other Reductions to only enter amounts that are specifically retained earnings adjustments. The key follow-up question is “how do I know if the additions and reductions on my tax return are retained earnings adjustments?”

To make this determination, you need to analyze the white paper detail for Line 3 and Line 5 of the Schedule M-2. Retained earnings adjustments can be positive or negative and therefore can appear on either Line 3 Other Additions or Line 5 Other Reductions.

On the white paper detail, the retained earnings adjustments can have many different names, but some common descriptions to watch for are “Prior Period Adjustments” and “Changes in Accounting Methods”. These are both items that can positively or negatively affect the retained earnings of the S Corporation, but they are not items of income or expense included in the calculation of taxable income.

Avoiding Pitfalls on Schedule M-2

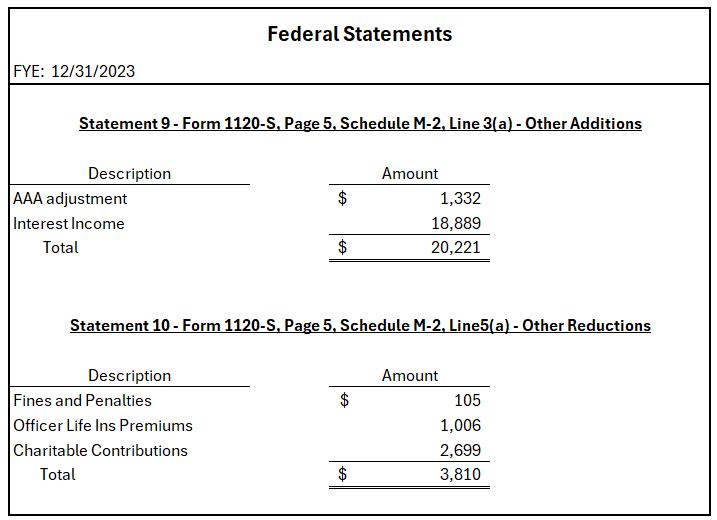

Please note that most items comprising Lines 3 or 5 of Schedule M-2 will be the separately stated items of income or expense from Schedule K. For example, you’ll commonly see “Interest Income” or “1231 Gains” as additions on Line 3 and “179 Expense” or “Charitable Contributions” as reductions on Line 5. If you are unsure if the item listed in the white paper detail is a retained earnings adjustment, check to see if it is a separately stated item of income or expense listed on the Schedule K. If it is an item listed on Schedule K, then it is not a Retained Earnings Adjustment and would not need to be included in the Schedule M-2 page of your spread in Bukers BTA Pro.

This point is illustrated in the example below, which includes white paper detail related to the Schedule M-2 for Form 1120S. In the example below, the only item we would spread as a retained earnings adjustment would be the AAA Adjustment of $1,332, as everything else represents separately stated items of income and expense from Schedule K.

If you have any further questions regarding this topic, please don’t hesitate to call our Bukers Hotline at (503) 520-1303.