Revocable Living Trust Listed as Partner on a K-1

What Does This Mean and How Does This Impact Cash Flow?

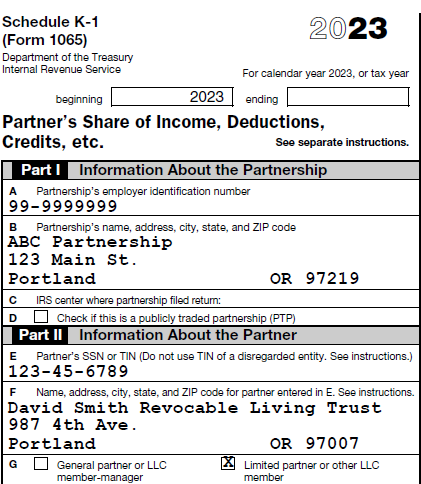

An analyst recently called the Bukers Hotline and asked, “I have a partnership K-1 paying sizeable distributions to the partner listed as David Smith Revocable Living Trust. How do I cash flow this with respect to my borrower, David Smith?”

Let’s start first by talking about living trusts. A living trust is an estate planning tool that allows someone, upon their death, to pass assets on to their beneficiaries while avoiding probate. Avoiding probate can save 8% to 11% of the assets by avoiding lawyer fees, court costs, etc.

Living trusts can either be revocable or irrevocable. Let’s focus on our analyst’s question about revocable living trusts first.

Revocable Living Trusts

With a revocable living trust, the trust creator (grantor) maintains control over the assets held by the trust, as well as the income or cash flow that the assets generate. They can easily modify or revoke the trust at any time during their lifetime.

For tax purposes, revocable living trusts are disregarded entities. In other words, while the grantor is living, the living trust is ignored for tax purposes. The owner of the living trust is the recipient of any cash from the trust assets.

In this example, David Smith is the owner and creator of the revocable living trust. He contributed his interest in this partnership to the living trust. But, because of the nature of living trusts, we’ll treat our analysis of David Smith as if he still directly owned the partnership interest. The distributions coming from the partnership go to David directly and should be treated as part of his personal cash flow.

Irrevocable Trusts

An irrevocable trust differs from a revocable trust in that the trust creator relinquishes control over the assets held by the trust and the trust cannot be easily modified. With an irrevocable trust, you would need to ask either the Fiduciary from the trust or the CPA who prepared the trust tax return (Form 1041) as to how much cash was actually distributed.

Conclusion

If you’re interested in more detailed explanations like this, look at Bukers Academy Online. Our new online training platform breaks down advanced topics like this into interactive learning modules designed to teach the advanced concepts necessary to analyze complex tax returns.