Schedule K-1 with W-2 Wages

Have you ever come across a Schedule K-1 that reports W-2 wages? Does this represent actual cash wages received by the recipient of the K-1? An analyst recently called into the Bukers Hotline with this exact question to determine if and how this affects their personal cash flow analysis.

The Quick Answer

To answer the question succinctly: the W-2 wages reported with the Schedule K-1 do not represent cash wages paid to the recipient of the K-1 and should be disregarded in your personal cash flow analysis. It’s important to understand why.

W-2 Wages on the Schedule K-1

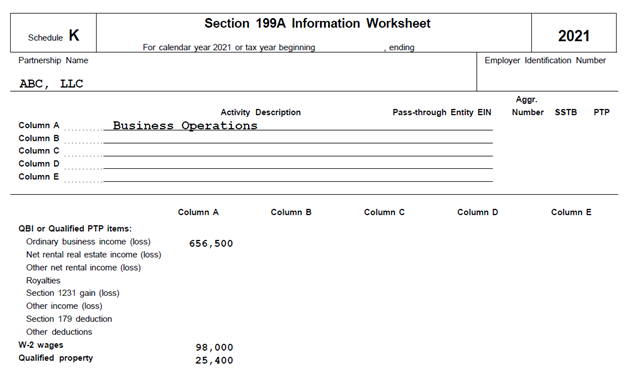

When analyzing a Schedule K-1 from a partnership or an S corporation for your personal cash flow analysis, you’ll commonly find additional statements that are included with the K-1 package. These statements will often report information relating to the Section 199A deduction, in other words, the qualified business income (QBI) deduction. This deduction allows taxpayers to deduct up to 20% of their qualified business income from a business operating as a sole proprietorship, partnership, S corporation, estate, or trust. The deduction is subject to numerous limitations including the amount of W-2 wages paid to all employees by the business entity. The Schedule K-1 will include additional statements that provide detail on all QBI limitations, including this W-2 wage limitation.

The above image comes from a K-1 received by an individual from her partnership, ABC, LLC, and reports $98,000 of W-2 wages. This represents the individual’s allocable share (based on her ownership percentage) of the partnership’s total W-2 wages paid to all employees of the business. The individual will then use this information to calculate her QBI deduction for her personal tax return.

These wages do not represent cash wages received by the individual. In fact, partnerships cannot pay direct W-2 wages to its partners. The W-2 wages reported on the Section 199A statements from a K-1 are only used for informational purposes by the accountant to calculate the QBI deduction. This value should be disregarded for your personal cash flow analysis.

If you have any similar questions, we encourage you to reach out to our team of experts through the Bukers Hotline at 503-520-1303. You may also submit a question through our website and we will quickly get back to you.