Section 1031 Exchanges with Zero Gain

Does a Section 1031 exchange with zero recognized gain create a cash impact to the borrower? Section 1031 exchanges, also referred to as like-kind exchanges, can result in massive tax savings for your borrowers. This is very popular and something you’ll often see for borrowers with real estate investments, but do you know how this impacts cash flow?

What is a Section 1031 Exchange?

In its simplest form, a 1031 exchange allows an individual to trade one piece of real estate for another piece of real estate and pay zero income tax on the exchange. Ideally, an individual or partnership can exchange one piece of real estate that has significantly appreciated for a separate property that is currently undervalued or has high potential for appreciation. If the exchange meets the specific rules and regulations of a Section 1031 exchange, capital gains tax can be deferred and no tax will be due upon the execution of the transaction.

1031 Exchange Example

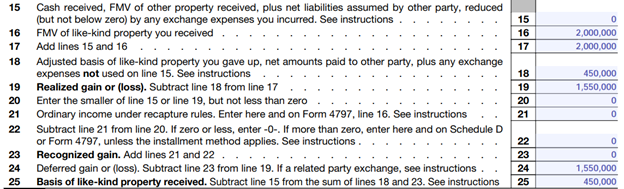

The answer is zero cash flow impact. If a like-kind exchange has $0 of recognized gain, then no cash was received by the borrower. If cash was received in any amount, that would cause gain to be recognized equal to the cash exchanged. Since no gain was recognized, that immediately tells us that no cash was received as part of the like-kind exchange. There is no cash flow impact to the borrower relative to this like-kind exchange.

Note, 1031 exchanges have many moving parts. While this example was straightforward, like-kind exchanges can become complicated quickly. The Bukers Taxanalysis Self-Study provides a deep-dive on 1031 exchanges along with many other vitally important topics for your cash flow analysis.