Setting Up a Bukers BTA File With Multiple Tax Returns or Financial Statements

Setting up your Bukers BTA file is quick and easy if you have two or three tax returns or financial statements to spread. But what if you have several to include in your spread? Read on to see how a simple trick in Bukers BTA can help to speed up this process.

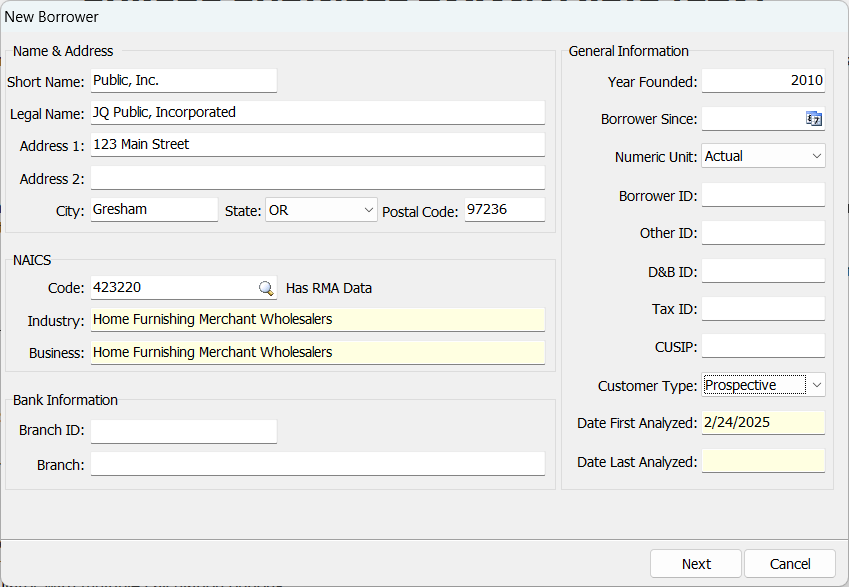

Let’s begin by creating a new file. Fill in the information requested on the New Borrower screen, and then click Next when finished.

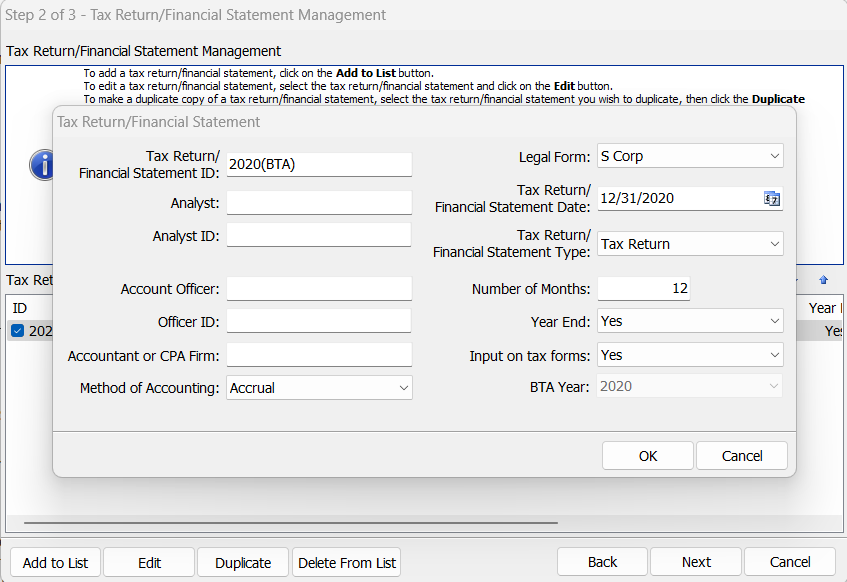

This brings you to the Step 2 of 3 – Tax Return/Financial Statement Management screen. Click Add to List to pull up the entry screen and enter the information for your first tax return or financial statement.

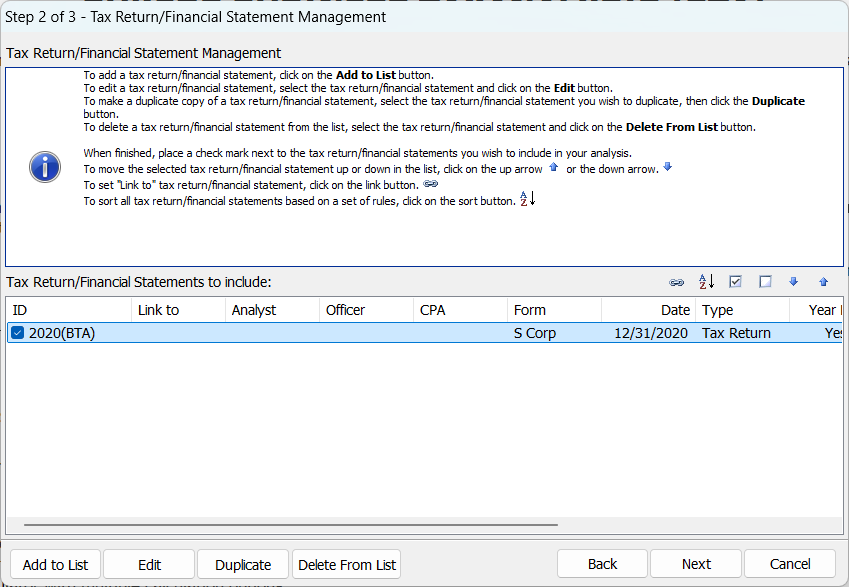

After entering all of the necessary information, click OK and you will return to the Step 2 of 3 – Tax Return/Financial Statement Management screen, with your first entry listed.

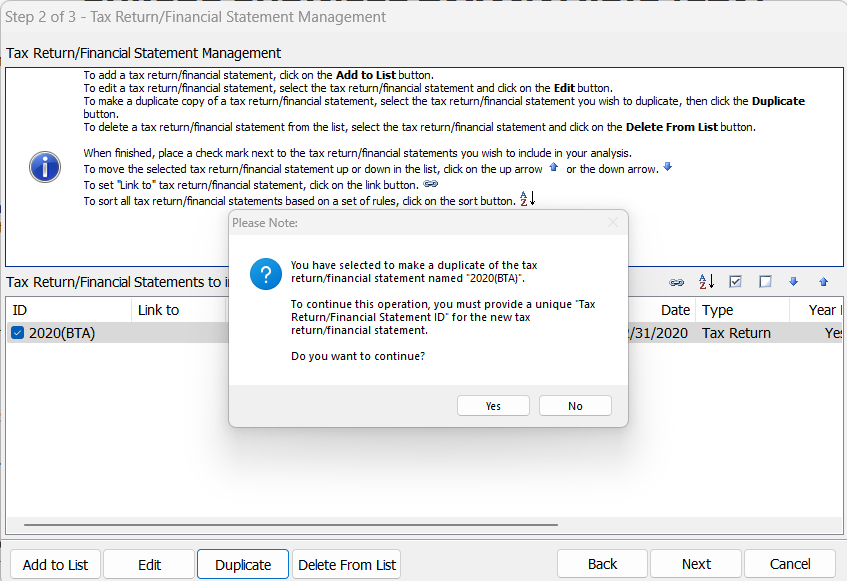

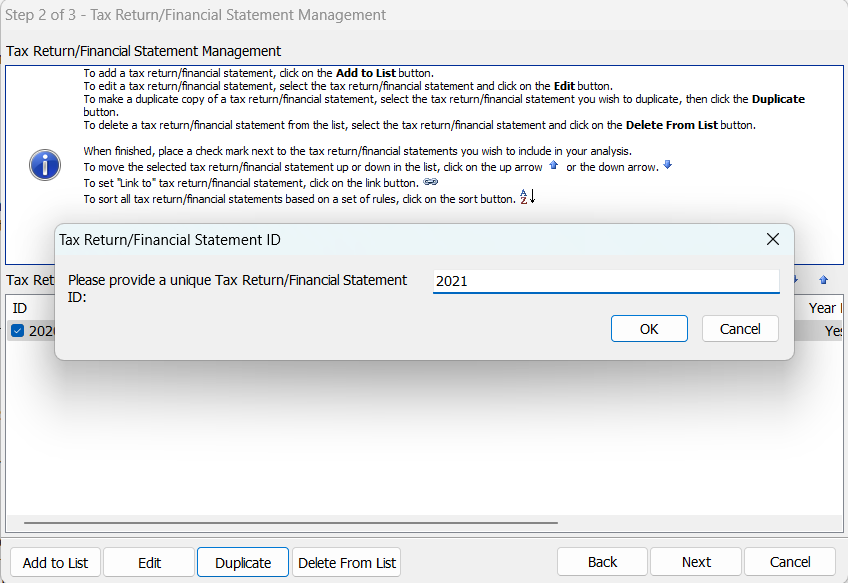

You can continue adding in tax returns and/or financial statements by repeating the process above, or you can speed things up a bit by utilizing the Duplicate button. When you click the Duplicate button, the selected tax return or financial statement will be duplicated with all of the same information. After doing so, you will first be prompted to provide a new name for the tax return or financial statement since duplicate names are not allowed.

Click Yes, then enter the new name, and then click OK when finished.

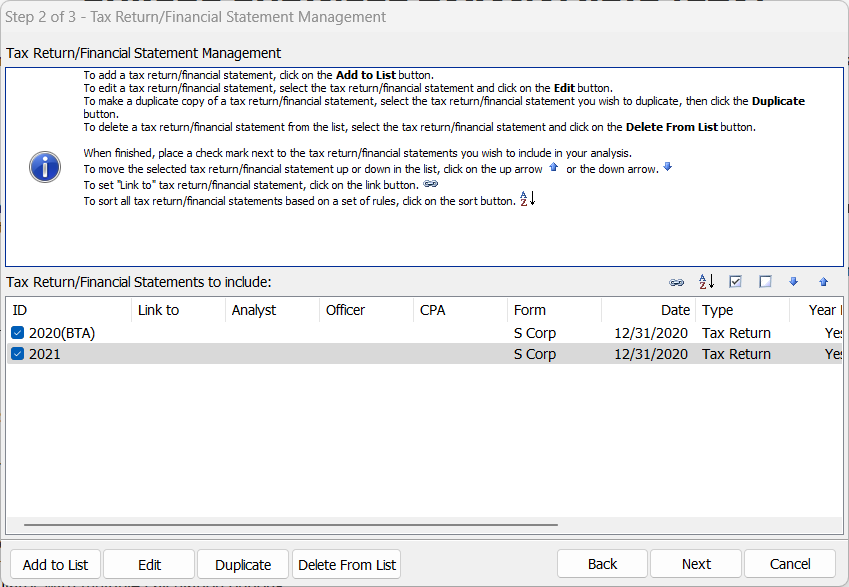

You will then be returned to the Step 2 of 3 Tax Return/Financial Statement Management screen with both entries listed.

Since this process creates an exact duplicate, the final step will be to update the duplicate entry with the applicable information for the new year. To update the information, click on the duplicate entry and then click the Edit button.

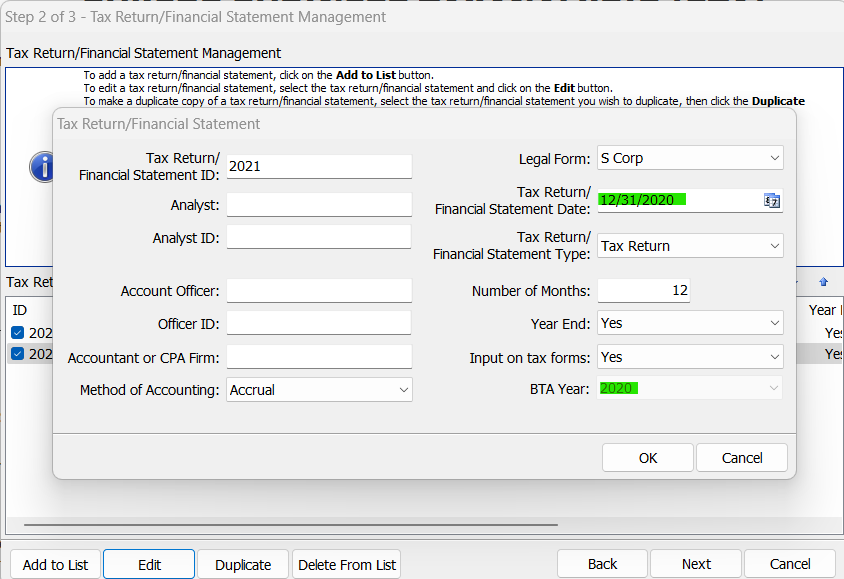

If the duplicate entry is for a financial statement, you will only need to change the Tax Return/Financial Statement Date to the applicable date for the new entry. If however, the duplicate entry is for a tax return, you will also need to change the BTA Year. To change the BTA Year, select Yes from the drop-down list next to Input on tax forms. This will trigger a new entry for BTA Year and will allow you to roll forward the BTA Year appropriately. When finished updating all of the information for the new entry, click OK.

To recap, here are the four simple steps to duplicate a financial statement or tax return in Bukers BTA:

- Set up your first tax return/financial statement.

- Select the first entry then click the duplicate button.

- Provide a new name for the duplicate entry.

- Make any changes to the new entry as needed.

If you ever have any questions about using the Bukers software or would like a walkthrough of their great features, please email us at support@taxanalysis.com or give us a call at (503) 520-1303.