Single-Member LLC on Schedule C

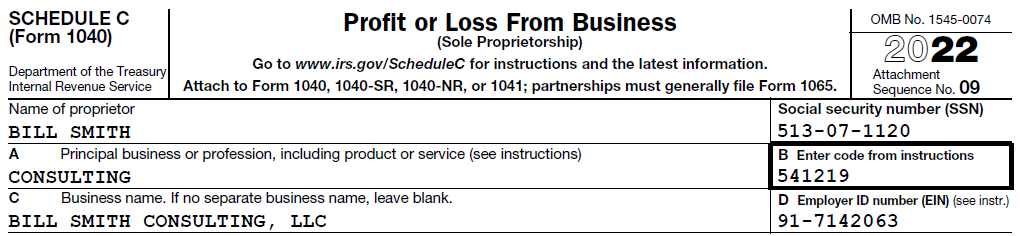

Have you ever seen a Schedule C with a name like “Bill Smith Consulting, LLC?” Are the income and expenses as shown on this Schedule C real cash flow?

Absolutely, these are real cash flow. What you’re looking at is a “single-member LLC” which is basically a regular Schedule C with an LLC shell wrapped around it for the liability protection of the Schedule C owner. In the example above, Bill Smith established an LLC to conduct his consulting business as a sole proprietorship. Because Bill is the sole owner of the LLC, the LLC is a “disregarded entity” where the LLC’s income and expenses will be reported on its owners tax return. The income from Bill Smith Consulting, LLC will be reported directly on the Schedule C of Bill Smith’s individual tax return (Form 1040).

Single-Member LLCs

Single-member LLCs allow the owner of a Schedule C – Sole Proprietorship, a Schedule E – Rental, or a Schedule F – Farm to wrap a protective shell around the entity in the form of an LLC. That is the only purpose of the single-member LLC, liability protection. It doesn’t change the fact that tax-wise, these are still a Schedule C, a Schedule E – Rental, or a Schedule F – Farm. So the amounts reported on these forms are real cash flow (excepting things like depreciation, amortization, etc.) and each should be cash flowed as a Schedule C, a Schedule E, or a Schedule F just like you would if they weren’t a single-member LLC.

Note, if the LLC had multiple owners or elected to be treated as a corporation, the LLC would file a separate business tax return such as a Form 1065, Form 1120-S, or Form 1120.

Questions

If you have similar questions, please call our team of experts through the Bukers Hotline at 503-520-1303. You may also submit a question online and we will quickly get back to you.